The advent of financial technology (fintech) has dramatically altered the way individuals manage their finances. Fintechzoom, a notable player in this field, offers a range of services designed to facilitate financial management and goal achievement. This article explores Fintechzoom’s features, assesses its effectiveness, and situates its role within the broader fintech ecosystem.

Overview of Fintechzoom

Fintechzoom is a digital platform providing users with tools and resources for financial management. Its services include investment guidance, market analysis, personal finance advice, and access to financial products. This section outlines the platform’s key offerings and the user interface experience.

Evaluating Fintechzoom’s Tools for Financial Goal Achievement

Investment Tools: Fintechzoom offers tools for stock market analysis, investment strategies, and portfolio management. This subsection assesses the efficacy of these tools in aiding users to make informed investment decisions.

Personal Finance Management: The platform provides budgeting tools, expense tracking, and financial planning resources. This analysis examines their usefulness in assisting users in managing their personal finances effectively.

Educational Resources: Fintechzoom provides educational content on various financial topics. This evaluation considers the depth and accuracy of this content and its role in enhancing users’ financial literacy.

User Experience and Accessibility

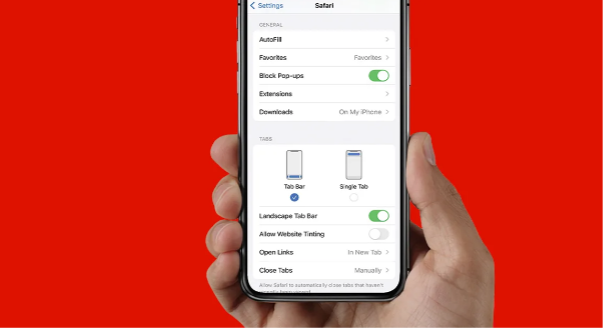

User interface and experience are critical in determining the effectiveness of fintech platforms. This section assesses Fintechzoom’s user interface, ease of use, and accessibility, considering diverse user demographics.

Security and Privacy Considerations

With the growing concern over data security in fintech platforms, this part of the article evaluates Fintechzoom’s security measures and privacy policies. It examines the platform’s compliance with regulatory standards and user data protection practices.

Comparative Analysis with Other Fintech Platforms

This section compares Fintechzoom with other fintech platforms in terms of features, user experience, and effectiveness in achieving financial goals. It highlights the platform’s unique selling points and areas where it lags behind its competitors.

The Role of Fintechzoom in the Broader Fintech Ecosystem

Fintechzoom’s role in the evolving fintech ecosystem is analyzed, considering its impact on financial inclusivity, innovation, and the traditional financial sector. This discussion also explores the platform’s potential in shaping future fintech trends.

Limitations and Areas for Improvement

Despite its offerings, Fintechzoom has limitations. This section identifies areas for improvement, such as the need for more personalized financial solutions and enhanced customer support.

Case Studies and User Testimonials

To provide practical insights, this section presents case studies and user testimonials. These real-world examples illustrate how Fintechzoom has helped individuals in achieving their financial goals.

Conclusion:

Fintechzoom emerges as a significant player in the fintech sector, offering a range of tools and resources that can potentially aid users in reaching their financial objectives. While it has several strengths, such as comprehensive investment tools and educational resources, areas for improvement remain, particularly in personalization and customer support. Its role in the broader fintech ecosystem is substantial, contributing to financial inclusivity and innovation. Further research and development are recommended to enhance its offerings and better serve its user base.